DeepDive Rio2 – Gold Developer Approaching First Pour

After doubling YTD, can Rio2 still deliver upside?

Summary: Why I’m Watching Rio2 (RIO.V) Heading into 2026

With construction underway and gold trading above $3,000/oz, Rio2 is quietly positioning itself as one of the next low-cost gold producers in the Americas.

Fenix Gold Project is fully permitted, fully funded, and on track for first gold in January 2026. Phase 1 targets ~91,000 oz/year at an AISC of ~$1,300/oz.

Management has done this before—they built and sold Rio Alto Mining for $1.1B after developing two heap leach mines in Peru. Now they’re running the same playbook in Chile.

An expansion study due by year-end could unlock a much larger 300,000 oz/year operation. Early valuation estimates suggest Rio2 trades at just 0.19x EV/NPV8 if expansion proceeds.

Even on a Phase 1-only basis, my model shows Rio2 trading at 0.46x EV/NPV8 using $3,000 gold—still leaving room for upside if execution stays on track.

In this deep dive, I cover:

Construction progress and project financing

2023 Feasibility Study and project economics

Expansion potential and water constraints

Insider alignment and change-of-control terms

Valuation scenarios and my personal position

If Rio2 delivers on its milestones, I believe it could move from developer discount to takeover candidate. Full breakdown below.

Disclaimer: Nothing in this post should be taken as financial advice. All opinions, estimates, and analysis are my own and purely for informational purposes. I hold shares in Rio2, so keep in mind I could be biased. Always do your own research before making investment decisions.

Introduction

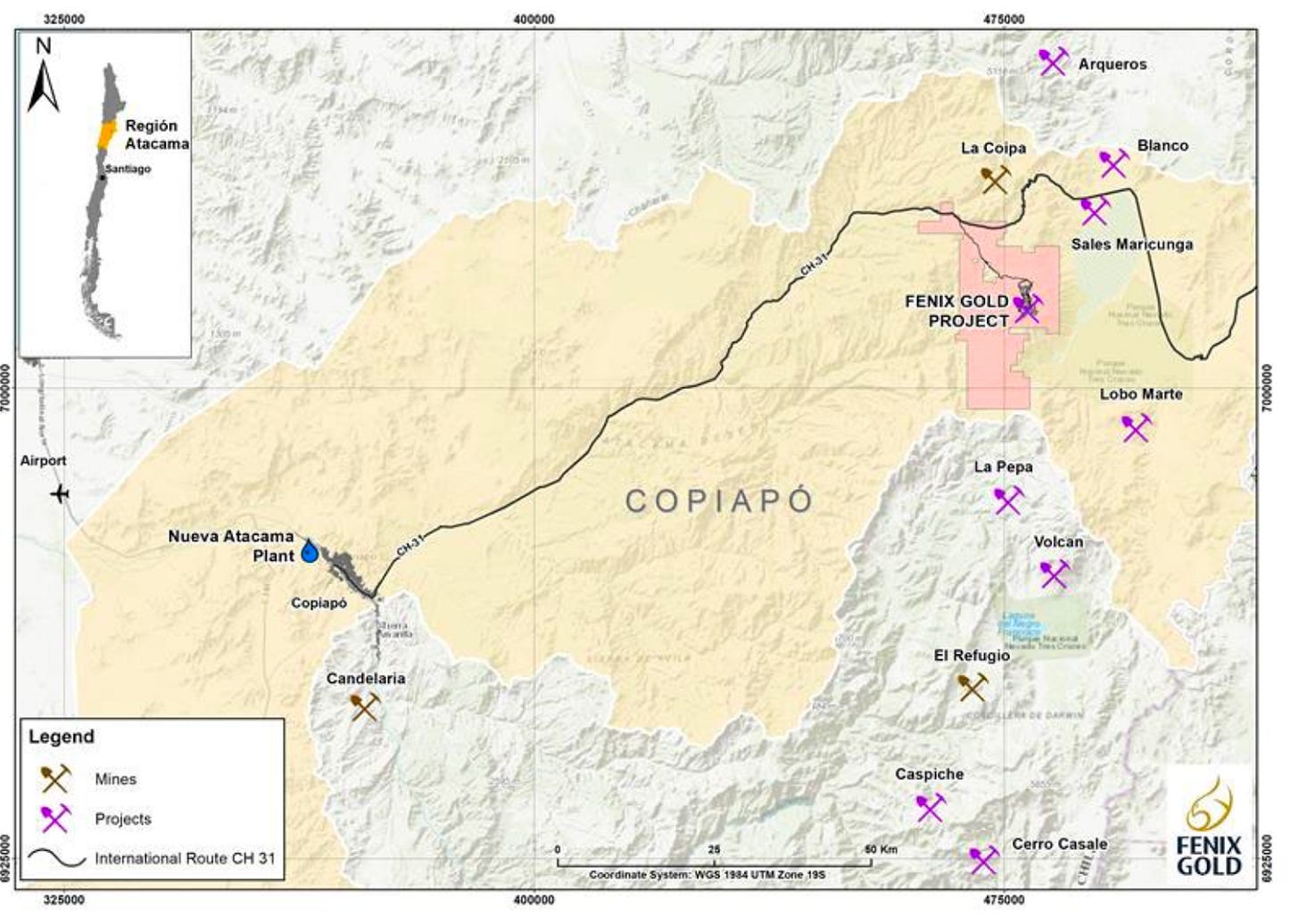

Rio2 Limited is a Canadian-based precious metals developer focused on advancing its 100%-owned Fenix Gold Project in Chile’s Atacama Region. The company is listed on the TSX Venture Exchange under the ticker TSXV: RIO and trades on the OTCQX under OTCQX: RIOFF.

With gold prices now exceeding $3,000 per ounce, Rio2 is well-positioned to transition into a high-margin gold producer and potentially benefit from a meaningful valuation re-rating upon reaching commercial production.

The Fenix Gold Project is one of the largest undeveloped oxide gold heap leach projects in the Americas, offering a simple, scalable production profile. Phase 1 construction is already underway, with the first gold pour targeted for January 2026.

While all mining projects carry inherent risks—including permitting delays, construction challenges, and ramp-up execution—Rio2 is led by a seasoned management team with a successful track record in Latin America, including the development and sale of Rio Alto Mining for $1.1 billion in 2015. This operational pedigree gives investors added confidence in the team’s ability to deliver on near-term milestones and unlock the project’s long-term potential.

Fenix Gold Project

The Fenix Gold Project is a 100%-owned oxide gold development project located in Chile’s Atacama Region, approximately 160 kilometers northeast of Copiapó, within the prolific Maricunga Mineral Belt, which hosts over 70 million ounces of historical gold endowment. Situated at an elevation of approximately 4,500 meters above sea level on the western slopes of the Andes, the project spans 37,291 hectares of exploration and exploitation concessions.

The site is accessible via 140 km of paved highway and 20 km of maintained dirt road, with a total travel time of roughly 2.5 hours from Copiapó. While there is no major infrastructure directly on site, the project lies 25 km from Chile’s national power grid, with a planned grid connection in a future phase. For initial operations, power will be supplied via on-site generators. The region benefits from proximity to Copiapó, a regional mining hub with a population of over 170,000 and access to a skilled labor pool and mining services.

Project History

Early Discovery & Exploration (2000s–2017):

Initially discovered by Chilean explorer SBX in the early 2000s, with mineralization found at the Cerro Maricunga formation.

Gold Fields and Atacama Pacific conducted systematic drilling and studies from 2010 to 2017, confirming the presence of a large, near-surface oxide gold deposit amenable to heap leaching.

Rio2 Acquisition and Project Advancement (2018–2021):

In 2018, Rio2 Limited acquired the project via merger with Atacama Pacific Gold.

Multiple drill campaigns followed, alongside updated geological and structural modeling.

A two-phase development strategy was outlined in the 2019 Pre-Feasibility Study (PFS), amended in 2021, targeting a low-strip ROM heap leach operation.

Feasibility Study & Technical Milestones (2022–2023):

A full Feasibility Study (FS) was published on October 16, 2023, confirming the technical and economic robustness of Phase 1.

Highlights included: 91,000 oz average annual production over the first 12 years, $116.6M initial capex, 74.6% gold recovery, and an after-tax NPV5% of $210M at $1,750/oz gold (Details covered in Feasibility Study section)

Permitting Journey (2020–2024):

Initial EIA submitted in April 2020.

EIA was rejected by the Atacama Regional Evaluation Commission in July 2022 despite Rio2's belief that all necessary studies were provided.

Following the rejection, Rio2 filed an administrative appeal to the Committee of Ministers in August 2022.

Approval was ultimately granted in December 2023, followed by receipt of the Resolución de Calificación Ambiental (RCA) in April 2024.

In October 2024, Rio2 secured all four sectorial permits, clearing the path to construction.

Financing (2022–2024)

In November 2021, Rio2 entered into a $50M gold stream agreement with Wheaton Precious Metals.

In March 2022, Rio2 received a $25M upfront deposit from Wheaton as part of the stream.

In October 2024, the company executed a full US$170M financing package, comprising:

US$100M Flexible Prepay Arrangement with Wheaton (95,000 oz gold delivery; 20% of spot price paid to Rio2).

US$20M Standby Loan Facility for cost overruns and ramp-up

C$5M private placement from Wheaton.

C$63M public equity offering

An amended gold stream agreement with Wheaton (more details in Financing section).

Construction Launch (2025):

On February 7, 2025, Rio2 officially announced the start of construction at the Fenix Gold Mine.

March 2025, the company had received the second $25M stream deposit from Wheaton

2023 Feasibility Study

On October 16, 2023, Rio2 published the Feasibility Study for the Fenix Gold Project, prepared by Mining Plus Peru S.A.C., a subsidiary of the Australian-based Mining Plus, a respected global provider of mining engineering and technical services. The study confirms the technical and economic viability of Phase 1 development.

Mining Method:

The study outlines a conventional open-pit, run-of-mine (ROM) heap leach operation, with a low average strip ratio of 0.85:1 over the 17-year mine life. The deposit’s near-surface, oxidized nature supports efficient mining using standard truck-and-shovel methods.

Production:

Phase 1 will operate at 20,000 tonnes per day, producing an average of 91,000 ounces of gold per year over the first 12 years and 82,000 ounces for the entire 17 year LOM. Initial output in 2026 is expected to be ~70,000. Total recovered gold over the mine life is estimated at 1.32 million ounces.

Recovery:

The project uses a ROM heap leach process with no crushing or agglomeration required. Metallurgical testing supports an average gold recovery of 74.6%, with low reagent consumption and favorable leaching kinetics demonstrated in both column and pilot-scale testing.

Risks:

Key risks identified include operating at high elevation (~4,500 m), weather-related logistics, and reliance on trucked water supply during Phase 1.

Capital Costs:

Initial Capital: US$116.6 million

Sustaining Capital: US$76.9 million

Closure Cost: US$11.1 million

Operating Costs:

Cash Cost: US$1,170/oz

All-In Sustaining Cost (AISC): US$1,237/oz

Economics:

The Feasibility Study outlines robust project economics at conservative gold pricing. At a base case of $1,750/oz, the project yields an after-tax NPV5% of $210 million, IRR of 28.5%, and a payback period of 2.75 years.

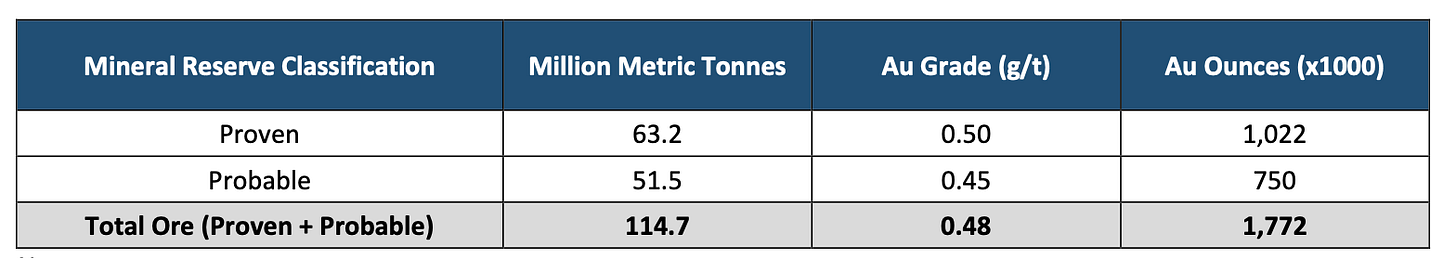

Resources and Reserves

The Fenix Gold Project hosts 1.77 million ounces of Proven and Probable gold reserves at an average grade of 0.48 g/t, as detailed in the October 2023 Feasibility Study. Measured and Indicated resources total 4.76 million ounces grading 0.38 g/t, with an additional 959,000 ounces in the Inferred category at 0.33 g/t.

These estimates are based on conservative gold price assumptions of $1,650/oz for reserves and $1,800/oz for resources. The deposit remains open at depth and along strike, with drilling to date extending only to a depth of 600 meters, indicating strong potential for future resource expansion through targeted exploration

Project Financing

On October 21, 2024, Rio2 announced a US$120 million financing agreement with Wheaton Precious Metals and a C$63 million equity financing, fully funding the construction and initial working capital for the Fenix Gold Project. The package includes the following components:

US$100 million Flexible Prepay Arrangement with Wheaton Precious Metals, in exchange for the delivery of 95,000 ounces of gold (approximately 8% of total life-of-mine production). For each ounce delivered, Rio2 will receive 20% of the spot gold price.

US$20 million Standby Loan Facility from Wheaton, available for potential cost overruns and ramp-up working capital. The loan carries an interest rate of 3-month SOFR + 9.5%, with no penalty for early repayment.

C$5 million non-brokered private placement from Wheaton, priced at C$0.65 per share.

C$40 million public equity offering, ultimately upsized to C$63 million, led by Raymond James Ltd. and Eight Capital. The offering involved the issuance of over 97 million shares at C$0.65 per share and closed on October 29, 2024.

Gold Stream Amendment:

As part of the revised financing structure, Rio2 also announced an amendment to its existing $50M gold stream agreement with Wheaton from November 2021. Under the amended stream terms:

6.0% of gold production will be delivered to Wheaton until both the Flexible Prepay Arrangement has been repaid and 90,000 ounces have been delivered under the original stream.

After that, the stream steps down to 4.0% of production until 140,000 ounces are delivered in total.

Beyond that point, the stream settles at 3.5% of life-of-mine production.

In addition, the amended agreement waives all accrued delay ounces through year-end 2026, and increases the per-ounce payment to 20% of the spot gold price (up from 18%) for all deliveries under both the stream and prepay arrangements.

Potential expansion

Rio2 is actively evaluating a large-scale expansion of the Fenix Gold Project, with a formal expansion study expected by December 2025. The company is targeting a potential scale-up from the current 20,000 tonnes per day (tpd) operation to 80,000 tpd, which could increase annual gold production to approximately 300,000 ounces. This expansion would transform Fenix into a top-tier heap leach gold producer in the Americas. The expansion timeline is expected to span 3 to 5 years, subject to permitting, financing, and logistical planning.

A key challenge for the expansion is securing a sustainable and scalable water supply solution. While Phase 1 operations are supported by trucking water to the site, this method is not viable for a higher throughput operation. Rio2 is therefore exploring long-term options, including a dedicated pipeline connection to regional water infrastructure and desalinated water sourcing, in collaboration with local authorities and stakeholders.

Notably, Rio2 is in active discussions with Kinross Gold, which operates the nearby La Coipa mine, to develop a shared water solution. This collaboration aims to build a direct water pipeline from the Aguas Chañar facilities in Copiapó to both mine sites. Such a partnership could create economies of scale, distribute infrastructure costs, and potentially serve other companies in the region, including planned lithium projects.

These solutions will be evaluated in detail as part of the upcoming expansion study, which is expected to outline the technical, environmental, and economic parameters of the next development phase.

Latest Developments and liquidity

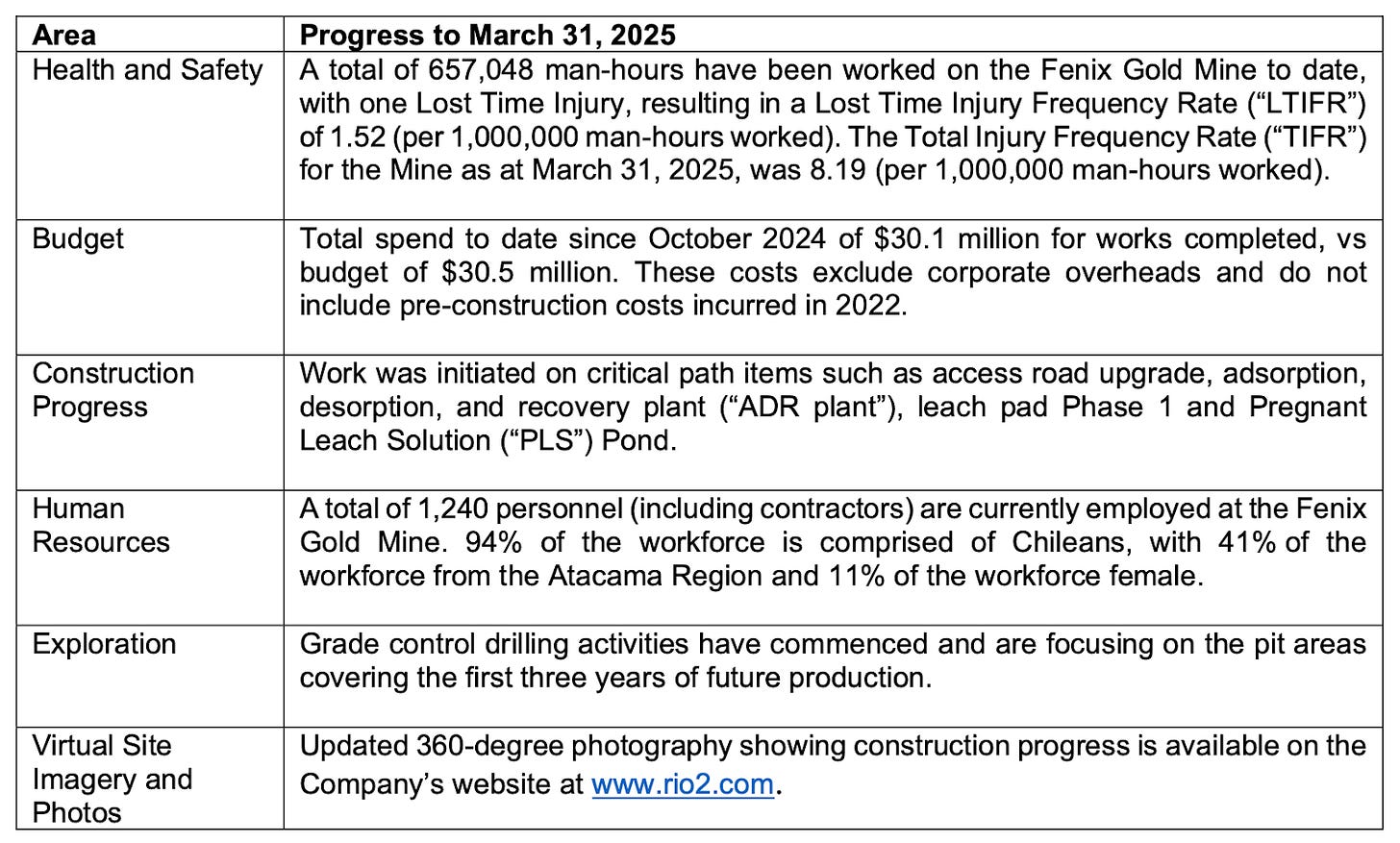

Construction Progress

At the end of Q1 2025 based on MDA construction at the Fenix Gold Mine was 19% complete and remains on track and on budget for expected first gold production in January 2026.

Financial Position

As of the end of Q1 2025, Rio2 reported US$48.2 million in cash and cash equivalents. The company is also entitled to receive an additional US$100 million under the Flexible Prepay Arrangement with Wheaton Precious Metals, with disbursements expected throughout 2025 and 2026 as construction milestones are met.

In addition, Rio2 has access to an undrawn US$20 million Standby Loan Facility from Wheaton, which is designated for cost overruns and ramp-up working capital.

Together, these funding sources provide Rio2 with a solid liquidity buffer to advance construction of the Fenix Gold Project without requiring near-term additional financing.

Next Milestones

November 2025 – Commissioning of the ADR plant, initiating the final phase of on-site processing infrastructure setup.

December 2025 – Completion of the Mine Expansion Study, expected to provide clarity on timing, scope, and economic potential for scaling up production beyond Phase 1.

January 2026 – First gold pour, officially marking Rio2’s transition from a developer to a gold producer.

Late 2026 to Early 2027 – Expected achievement of full nameplate capacity, signaling stable commercial production and operational ramp-up completion.

Management and Board of Directors

Rio2’s leadership team has a proven track record of financing and building open-pit gold mines in Latin America—specifically in high-altitude, heap-leach environments similar to the Fenix Gold Project. The team’s deep technical, financial, and operational experience is directly applicable to the execution challenges ahead.

Notably, several members of Rio2’s senior leadership and board played key roles in the success of Rio Alto Mining, which developed and operated the La Arena and Shahuindo mines in Peru. Both were oxide gold, open-pit, heap-leach operations located at high elevations—much like Fenix. Rio Alto was ultimately sold to Tahoe Resources in 2015 for $1.1 billion, a clear demonstration of management’s ability to deliver value through disciplined execution.

Key management and board members:

Alex Black (Executive Chairman) With over 40 years in the mining industry and a degree in Mining Engineering, Mr. Black previously built Rio Alto Mining into a $1.1 billion company with two high-altitude, heap-leach gold mines in Peru (La Arena and Shahuindo). His deep expertise in mine construction, permitting, and Latin American operations is directly applicable to Fenix.

Andrew Cox (President & CEO) A geologist by training with over 24 years of global operational experience, Mr. Cox held key roles at Rio Alto Mining—including operations manager at La Arena and acting operations manager during the start-up of Shahuindo. His experience managing open-pit gold operations positions him well to lead execution at Fenix.

Klaus Zeitler (Lead Independent Director) A veteran mining executive with global experience financing and developing over $4 billion worth of projects. As former Executive Chairman of Rio Alto, he helped steer the company through two major mine builds. Dr. Zeitler brings governance depth and extensive South American project oversight experience.

Albrecht Schneider (Director) Co-founder of Atacama Pacific and discoverer of the Cerro Maricunga deposit, he has over 25 years of geological leadership in South America. He remains a major shareholder and geological advisor.

Ram Ramachandran (Director) Brings over 35 years of financial oversight experience, including senior roles at the Ontario Securities Commission. He chairs the Audit Committee.

Sidney Robinson (Director) Former senior partner at Torys LLP, with significant experience advising large mining firms on M&A and governance matters. Also a former director at Rio Alto and Inmet Mining.

Drago Kisic (Director) Economist and corporate leader with experience in resource governance, including board roles at Rio Alto and Tahoe Resources. Former senior official at Peru’s central bank and Ministry of Foreign Affairs.

Insider Ownership

I’m encouraged by the strong insider alignment at Rio2. Executive Chairman Alex Black holds a meaningful 4.3% stake, while Director Albrecht Schneider owns approximately 2.7%—both reflecting long-term conviction in the Fenix Gold Project.

However, CEO Andrew Cox currently owns only around 0.11% (463,632 shares), which is relatively modest given his leadership role. Personally, I would prefer to see a higher ownership stake from the CEO.

I also view the 7.3% stake held by Eric Sprott (via Ontario Ltd.) as a major positive. Sprott—a highly regarded Canadian billionaire and one of the most prominent investors in the precious metals space—brings additional credibility to the shareholder base and signals institutional confidence in Rio2’s long-term potential.

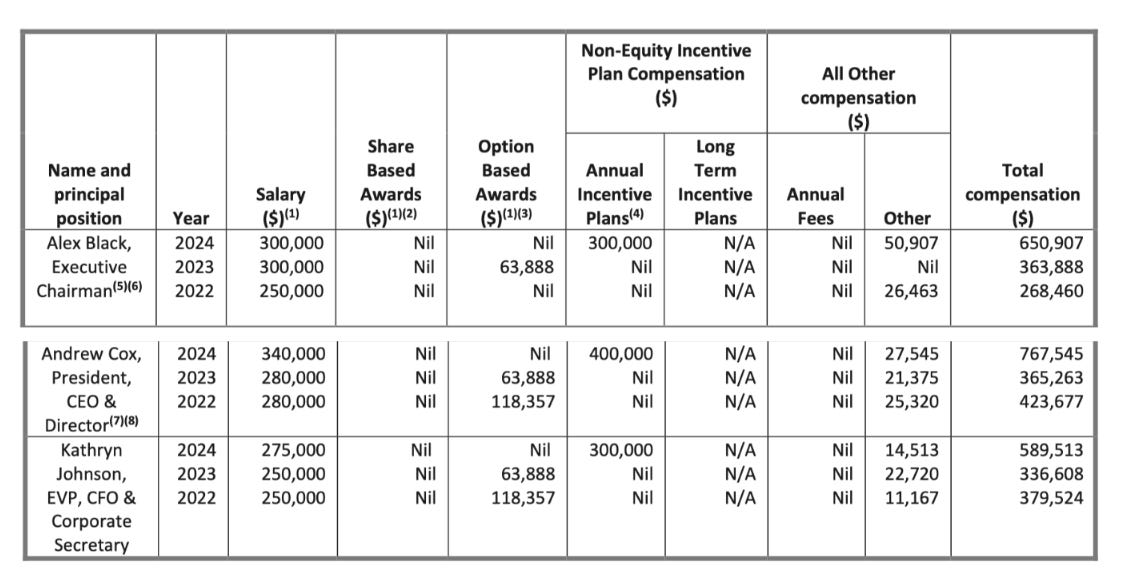

Management Compensation

In 2024, Executive Chairman Alex Black received total compensation of US$651K, while CEO Andrew Cox earned US$767K. For a pre-revenue company, these compensation levels are on the higher end—but not unreasonable given the team’s strong development track record.

That said, I believe that executive share ownership should reflect long-term alignment. Ideally, management should hold equity worth at least 5x their annual compensation. Currently, CEO Andrew Cox’s ownership is below this benchmark—holding less than one year’s worth of shares at current market value.

Change of Control and Termination Benefits

According to the April 17, 2025 Management Information Circular, if any of Rio2’s senior executives are terminated following a change of control, or within 12 months thereafter, they are entitled to:

24 months of base salary

2× annual target bonus (if such a bonus has been set by the board)

Immediate vesting of all unvested equity awards

Estimated Severance Benefits

Includes both cash severance and the estimated value of accelerated vesting of stock incentives, based on a C$0.64 share price and an FX rate of 1.4389. (Assuming termination occurs on December 31, 2024)

Overall, these change-of-control terms are broadly in line with annual compensation levels, and I view them as appropriate—not excessive or likely to incentivize a premature sale of the company.

Share Structure

As of March 31, 2025, Rio2 has 447 million basic shares outstanding and 22.4 million options with an average exercise price of C$0.56. The company has no outstanding warrants or RSUs, which simplifies the capital structure.

While a large number of near-term expiring options or warrants can sometimes weigh on share performance, Rio2’s share structure is relatively clean and not overly dilutive. I do not currently see it as a material overhang or risk to shareholders.

Valuation

To assess the potential value of the Fenix Gold Project, I’ve modeled after-tax NPV under two development scenarios:

Base Case: Phase 1 development only (20,000 tpd throughput)

Expansion Case: Incorporating a scale-up to 80,000 tpd (subject to the 2025 Expansion Study)

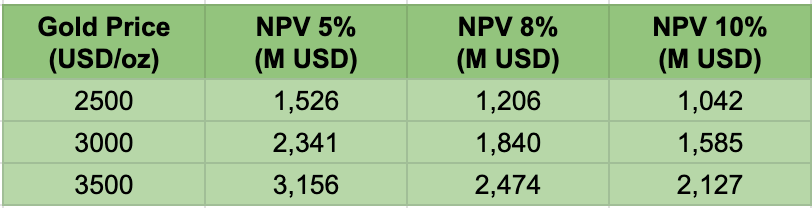

For both scenarios, I estimate project-level NPV using three gold price environments ($2,500, $3,000, $3,500/oz) and three discount rates (5%, 8%, 10%).

Base Case – No Expansion

Key assumptions:

AISC: $1,300/oz (FS: $1,237/oz)

Production: ~70,000 oz in 2026 (ramp-up), ~100,000 oz in 2027, later years as Feasibility Study

Wheaton Deliveries: 95,000 oz over 7 years as per prepay schedule, at 20% spot price

Stream Obligations: 6%–4%–3.5% of production (life-of-mine), additional to prepay

Tax Rate: 27% (per Chilean statutory rate in FS)

Capex: Only initial $116.6M Phase 1 cost modeled; expansion costs excluded in this case

At $3,000/oz gold, my base-case model estimates the Fenix Gold Project’s after-tax NPV8 at approximately US$762 million. With Rio2 currently trading around C$1.20/share (or ~US$0.90/share) and a fully diluted share count of ~447 million, this implies a fully diluted enterprise value of ~US$350 million. That equates to a valuation of ~0.46x EV/NPV8.

Expansion Case – Preliminary Estimate

This scenario is very speculative but helps frame long-term potential. Assumptions include:

Expansion completed in 2030

Adds ~180,000 oz/year to production (~270,000 oz total) from 2030

AISC: $1,400/oz post-expansion (taking inflation into account, I believe costs will be higher—even with the advantages of larger-scale operations)

Expansion CAPEX: $400 million (broad estimate)

At $3,000/oz gold, this scenario yields a project-level NPV8 of approximately US$1.84 billion, implying an EV/NPV8 multiple of just 0.19x—highlighting substantial upside if confirmed by a formal study.

Even at a lower gold price of $2,500/oz, the project still delivers an estimated NPV8 of US$1.2 billion, providing investors with a meaningful margin of safety.

Cash Flow Potential

Looking at 2027, if Rio2 hits its production target of ~100,000 ounces and delivers 15,000 ounces to Wheaton under the prepay deal, the company would retain ~85,000 payable ounces. At a $3,000/oz gold price, this could generate US$120–150 million in cash flow (before tax). That equates to a 30–37% cash flow yield on the current market cap.

Takeaway

In my view, if gold remains strong and Rio2 continues to execute, the company still offers meaningful rerating potential. The market appears to be heavily discounting both the expansion optionality and the possibility that gold sustains elevated prices. If Rio2 proves it can deliver, there’s room for a material revaluation.

Risks

As a pre-revenue company advancing its first project toward production, Rio2 carries a high risk profile. While the Fenix Gold Project has a strong technical foundation and experienced leadership, several material risks remain that investors should closely monitor:

Construction Delays and Cost Overruns: Even with a fixed-price contract in place for the ADR plant, unforeseen issues in logistics, contractor performance, or inflationary pressures could delay timelines or increase capital costs.

Ramp-Up and Operational Execution: Transitioning from construction to steady-state production is often the most challenging phase for single-asset developers. Failing to reach nameplate capacity on schedule could materially impact early cash flow and investor confidence.

Underperformance vs. Feasibility Study Assumptions: Lower grades, weaker gold recovery, or operational inefficiencies could lead to significantly worse-than-expected project economics, especially in the first years.

Permitting and Regulatory Hurdles: Although major permits are in place, the Fenix project’s earlier rejection highlights ongoing jurisdictional and environmental sensitivities in Chile.

Water Supply Constraints: Phase 1 operations will rely on trucked-in water, but future expansion will require a more scalable and reliable water solution. Failure to secure this could constrain growth or add capital intensity.

Unforeseen Technical or Environmental Issues: As with all mining projects, especially those at high elevation, there’s always the possibility of unexpected geotechnical, climatic, or environmental challenges not captured in current studies.

Gold Price Volatility: As a single-asset gold developer, Rio2’s valuation and cash flow outlook are highly sensitive to gold price movements. A significant decline in gold prices would directly affect project economics, funding flexibility, and market sentiment.

Investors should treat Rio2 as a high-risk/high-reward opportunity, with returns highly sensitive to execution and gold price.

Conclusion

Rio2 has already delivered strong returns in 2025, with the share doubling year-to-date. Still, I believe the company’s valuation offers further upside — assuming it continues executing on its transition from developer to producer. The next 6–12 months will be critical: staying on budget, delivering first gold on time, and ramping up to full nameplate capacity are key milestones that could drive a meaningful re-rating.

Any delays or setbacks during construction or start-up could weigh on sentiment and liquidity. But with each milestone achieved on schedule, confidence in the Fenix Gold Project and in the management team should grow accordingly.

The Mine Expansion Study, due by year-end, will be a major catalyst. If it confirms the technical and economic viability of a 300,000 oz/year operation, it could significantly reshape how the market values Rio2’s long-term potential.

Should execution stay on track, Rio2 may also attract interest from larger gold producers looking to add scalable, low-cost assets in mining-friendly jurisdictions. In that context, Fenix has a real chance of being recognized as a future Tier 1 gold asset.

Importantly, I also see strong downside protection in the current valuation. Even at a reduced gold price of $2,500/oz, my model suggests the stock still trades at a conservative multiple relative to project NPV—meaning the risk-reward remains favorable.

After the rally to nearly C$1.40 and the recent pullback toward C$1.20, I’m holding my current position. But if the stock weakens further while gold holds above $3000 and Rio2 continues to execute, I’d be open to adding on dips.

Thanks for taking the time to read my first deep dive—I hope you found it helpful.

As this is my first long-form analysis, I’d really appreciate your feedback in the comments:

What did you find most useful?

Which sections felt too light or too detailed?

Are there areas you’d like me to explore more thoroughly in future write-ups?

I’ll try to improve with each new piece.

Also, if there are specific companies you’d like me to cover next—especially in the gold, silver or uranium — drop them below. I’m always looking for new ideas worth digging into.

Thanks again for your time and support.

Want to support the next edition? A coffee would mean a lot and help me keep digging

Amazing work. As a student of the sector myself, comparing notes is essential for my own learning process. I, personally, would appreciate having the NPV calculation formula used in the calculation listed somewhere. This makes easy comparing what is or isn't included or if the approach has terminal value included. This information could be inferred but given how detailed your deep dive is... I, personally, would appreciate it.

I suggest you consider doing a deep dive on Minera Alamos - on the Canadian exchange with symbol MAI. I thought your write up on RIO2 to be well researched and well presented. I have a price per share target for RIO2 of C$8.00, but I assume a major or mid-tier will buy the company out before that. I think that WATER for the Fenix expansion is the major issue a buyer would want to see nailed down before making an offer.